CrossFraud Enterprise Financial Risk Management solution for reducing frauds across multiple channels, business areas and entities

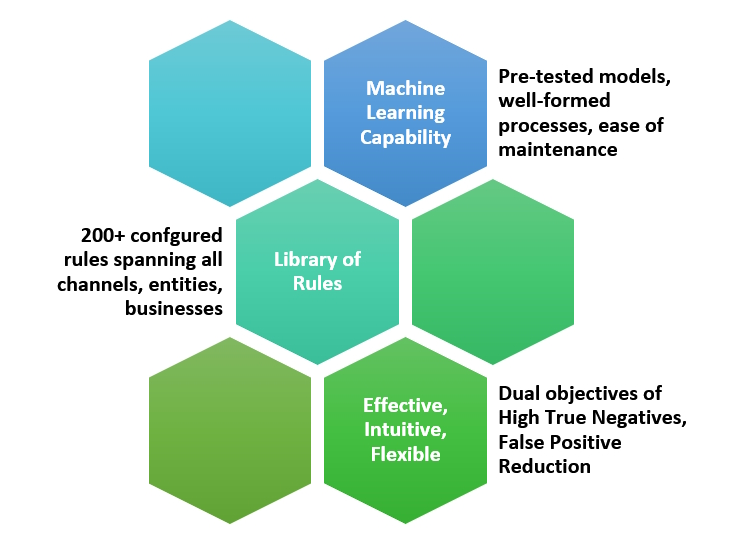

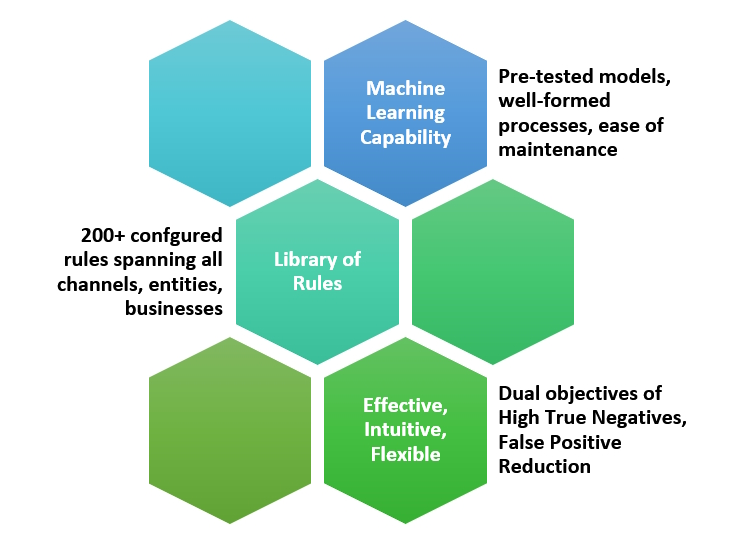

CrossFraud® offers intuitive tools to configure simple to complex fraud scenarios, simulate outcomes, and take timely actions. With CrossFraud®, financial institutions can effectively address challenges of preventing financial losses on account of Phishing, Vishing activities, Payments fraud, ATO, ATM skimming, Internal Fraud, Loan Fraud and many other such ever evolving areas of financial fraud risk.

CF Team has tuned and tested cross-section of Machine Learning (ML) models spanning Supervised Learning, Unsupervised Learning, Neural Networks and has a shortlist of best-fit models for the financial fraud scenarios. Some of models from the list are – Random Forest, FNN, RNN, etc.